ProphetX Signals are programmable functions in ProphetX that call attention to when the sought-after action occurs on a chart. Signal Lines are often used in conjunction with technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. They are called signal lines because when another indicator or line crosses them, it is a signal to trade or that something potentially important is happening with the price of an asset.

ProphetX offers a variety of default signals for several common indicators as well as candlestick formations. Each of these can be cloned and then customized to the user’s preference. Users can also create their own customer signals.

Key Takeaways

- A Signal line is not a technical indicator in and of itself.

- It is often a moving average of an indicator that is applied to the indicator so that the signal line and indicator can cross to generate trade signals.

- Signal lines may be used in different ways for different indicators. Typically, when the indicator crosses above the signal line, it is interpreted as bullish for the price and when it crosses below it is bearish for price.

Adding a Signal to your Chart

There are two ways to add a Signal to a Chart.

-

- Create the base chart and add any preferred studies

- Right mouse click to bring up a menu

- Click on Add Signal…

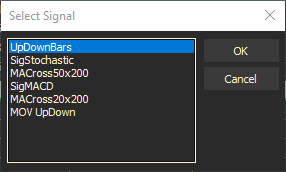

- From the Signal Menu box, select the signal you want to add to your chart.

- Click on OK to add to Chart

OR

- Select Studies & Filters from the Docked Menu

- Open the folder called Signals

- Drag and drop the desired Signal onto your chart

You can easily change the properties of the signal by right mouse clicking on the signal in question. Change the color, Icon or if an Alert Text is shown.

To make the changes permanent for future use, right mouse click and choose Clone. Signals that begin with DTN, will remain with the default settings. Signals without DTN can be renamed, changed and saved.

- Abandoned Baby

- This is a three-bar reversal pattern used found on a candlestick chart. It consists of 3 bars that cannot overlap, making this pattern very unique, rare and reliable.

- The 1st candlestick is the direction of the primary trend.

- The 2nd is a doji which gaps in the direction of the primary trend, with no overlap with the real body or shadow of the previous candle.

- The 3rd is the opposite direction of the 1st day and gaps in the opposite direction of the doji.

- A Bullish Abandoned Baby pattern will signal a reversal of a downtrend.

- A Bearish Abandoned Baby will signal a reversal of an uptrend.

- This is a three-bar reversal pattern used found on a candlestick chart. It consists of 3 bars that cannot overlap, making this pattern very unique, rare and reliable.

- BreakAways

- A breakaway identifies a strong price movement, like those established during a trading range.

- Dark Cloud

- This is a bearish reversal candlestick pattern where a down candle opens above the close of the prior candle, and then closes below the mid-point of the up candle.

- DayStars (Morning Star / Evening Star)

- Is a chart pattern used to detect when a trend is about to reverse.

- An Evening Star consists of 3 candles; a large white candle signifying a continued rise in prices, a smaller candle that shows a more modest increase in price, and a large black candle than opens at a price below the previous day and then closes near the middle of the first day.

- The Morning Star is the opposite of the Evening Star. It forms following a downward trend and indicates the start of an upward climb.

- Doji

- Shows there is indecision in the markets

- A Doji involves a small candlestick body, with higher and lower wicks.

- Alone, doji are neutral patterns that are also featured in a number of important patterns.

- Engulfing

- The bearish engulfing candlestick performs best after a downward breakout.

- Indicates an upward trend.

- Two candlestick indicator, the 1st white and the 2nd The black is taller and overlaps the white candle.

- The bullish engulfing candlestick indicates a downward trend.

- Two candlestick indicator, the 1st is black followed by a taller white candle.

- The white candle should have a close above the prior open and an open below the prior close

- The bearish engulfing candlestick performs best after a downward breakout.

- Hanging Man

- The hanging man occurs when two criteria are present:

- An asset has been in an uptrend

- The candle has a small real body and a long lower shadow.

- The hanging man occurs when two criteria are present:

- Haramis

- The pattern will contain two candles and the second will be smaller than the first.

- The 1st candle must continue with the trend’s direction. It ill be the same color and the current trend and will have a long body.

- The longer the candles, the more forceful the reversal should be.

- Kickings

- A Kicking pattern is a two-bar candlestick pattern that predicts a change in the direction of an asset’s price trend.

- This pattern is characterized by a sharp reversal in price over the span of the two candlesticks.

- Traders use kicker patterns to determine which group of market participants is in control of the direction.

- The pattern points to a strong change in investors’ attitudes towards a security that typically follow the release of valuable information about a company, industry or economy.

- MACross 20×200

- Moving average crossovers are very popular among currency traders.

- Consists of a fast MA and a slow MA with different period settings to create a crossover trading system.

- This signal users 20-period and 200-period moving averages.

- MACross 50×200

- Moving average crossovers are very popular among currency traders.

- Consists of a fast MA and a slow MA with different period settings ot create a crossover trading system.

- This signal users 50-period and 200-period moving averages.

- MOV UpDown

- Signals when current period’s 200 MOV is higher than previous period’s 200 MOV.

- Pierces

- This is formed with multiple candlesticks.

- This pattern is a bullish reversal pattern that needs to form after a move or trend is lower.

- The 1st candlestick is a significant bearish candlestick with little to no wicks.

- The 2nd candlestick then gaps lower than the previous, but the buyers come in, and the candle finishes above the mid-way point of the 1st candle.

- SigMACD

- Plots icon over periods when standard MACD fast and slow cross over.

- SigStochastic

- Signals overbought and oversold conditions as well as K & D crossovers based on standard Stochastic formula.

- Three Black Crows

- Is a bearish candlestick pattern that may predict the reversal of an uptrend.

- The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle.

- The size of the three black crow candles and the shadow can be used to judge whether the reversal is at risk of a retracement.

- The opposite of three black crows is three white soldiers.

- Three Line Strike

- Is a three line strike reversal pattern that carves out three black candles within a downtrend. Each bar posts a lower low and closes near the intrabar low. The fourth bar opens lower but revers in a wind-rand outside bar that closes above the high of the first candle in the series.

- Three Soldiers (Three White Soldier)

- This is a bullish candlestick formation that hints at a new move higher.

- The pattern is formed when there are 3 consecutive bullish candlesticks that have little to no wick and open within the body of the previous candlestick

- Tweezers

- Tweezer Bottom

- This candlestick forms at the bottom of a move lower.

- The 1st candlestick is bearish, and the 2nd is bullish.

- The low of these candlesticks will be almost the same.

- Tweezer Top

- This is the inverse pattern of the above.

- Tweezer Bottom

- UpDownBars

- Assigns up/down colors to chart types that do not normally do so.