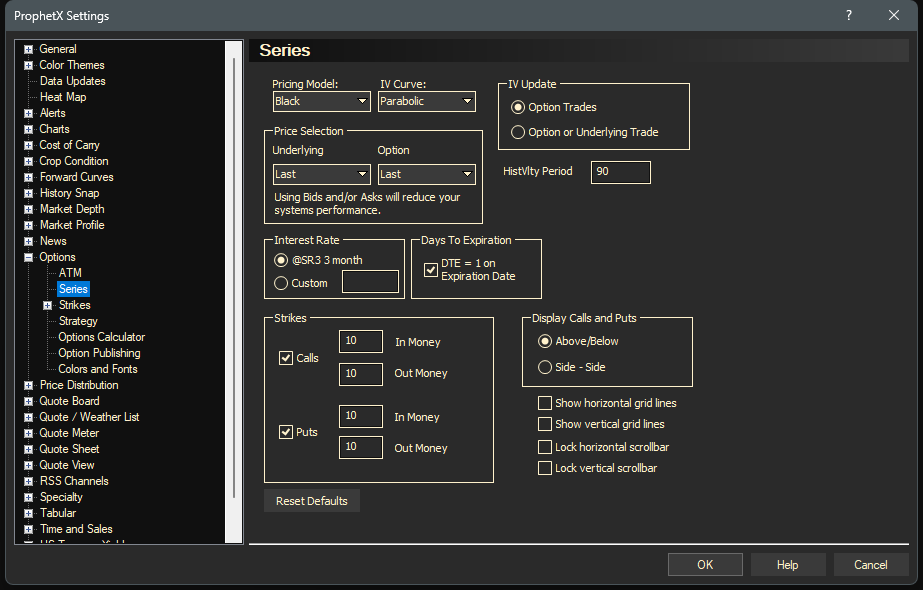

The Series display shows call and puts in and out of the money for individual options months.

- Pricing Model

- Model – Select the default model – Black, Black Scholes, Garman K, CRR European or CRR American

- IV Curve

- Select the curve to be calculated.

- IV Update – Specifies when the options should update

- Option Trades – calculate the Implied Volatility only when the option trades. The underlying price used in the calculation is the price at the time the option last traded.

- Option or Underlying Trade – calculate the Implied Volatility of the option when either the option or its underlying instrument changes in price.

Tip: Many users question these updates because the default is to calculate only when the option price itself changes. If you want your options to update when the underlying price changes, as well as when the option price changes, select the second selection.

- Price Selection:

- Underlying and Option – determines the data to be used in the options calculations

- Interest Rate

- Specifies the interest rate used in the pricing model of all options. A change in this value will be reflected in the IRate field of the underlying section.

- Days To Expiration

- DTE = 1 on Expiration Date. If checked it will display the expired options thru the last day.

- Strikes –Shows how many calls and puts to display:

- Calls – enter the number of calls you would like to display for In Money and Out Money

- Puts – enter the number of Puts you would like to display for In Money and Out Money

- Display Calls and Puts – Specifies how you want the calls and puts displayed.

- Above/Below – view the Calls and Puts Above/Below

- Side – Side – view the Calls and Puts Side by Side