The Cox-Ross-Rubinstein binomial option pricing model (CRR model) is a variation of the original Black-Scholes option pricing model. The model is popular because it considers the underlying instrument over a period of time, instead of just at one point in time. It does this by using a lattice-based model, which takes into account expected changes in various parameters over an option’s life, thereby producing a more accurate estimate of option prices than created by models that consider only one point in time. Because of this, the CRR model is especially useful for analyzing American style options, which can be exercised at any time up to expiration (European style options can only be exercised upon expiration). And, unlike the original Black-Scholes option pricing model, the CRR model has the ability to take into account the effect of dividends paid out by a stock during the life of an option.

Adding the Cox-Ross-Rubinstein Pricing Model to the Options Series view

This model is only available on the Options Series view.

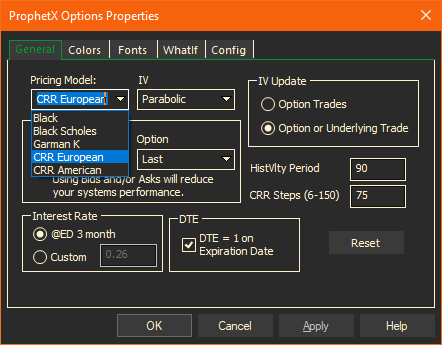

- Once you have this view open, right mouse click and select Properties

- From the Pricing Model drop down, select one of the following:

- CRR European

- CRR American

- Click OK