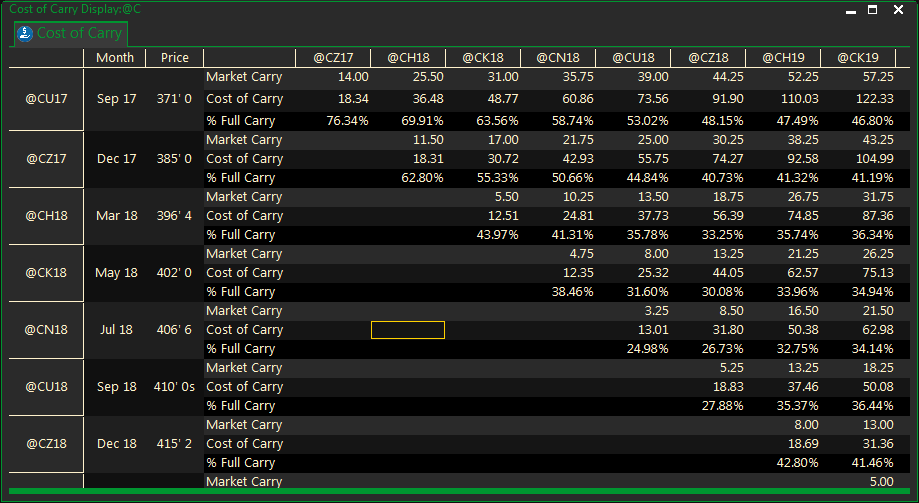

The Cost of Carry Calculator is a matrix that shows the prices for a futures contract chain and calculates Cost of Carry, Market Carry and %Full Carry.

- Cost of Carry is the cost related to holding grain from one month to another. This cost is primarily interest & storage but also includes shrink and insurance.

- The formula is: (Current Futures Price * (Days/365) * IR%) + ((Days/365) * 12 * Monthy Storage * 100)

- Market Carry is the difference between the current contract and a future contract.

- % of Full Carry is the percentage of the costs of carry that the market carry covers. (Market Carry/Cost of Carry)

- In the past, 80% has been generally considered as Full Carry.

To view Cost of Carry

- Select Quotes/Calculator from the Main Menu Bar

- Select CostOfCarry from the drop down menu

- Select the product you want to view from the buttons representing the various grains on the context tool bar

(Press the F2 key to toggle the context tool bar on or off.)

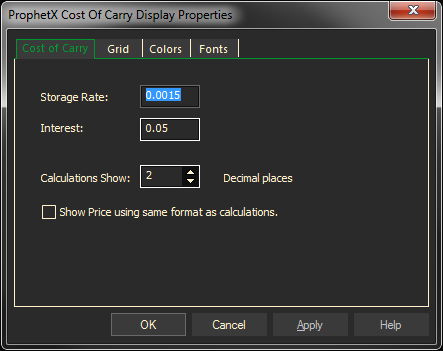

Changing Storage and Interest Rates (Sheet Properties)

- Right click in the display and select Sheet Properties

- Make changes to Storage and /or Interest Rate and select Apply and OK

Tip: When using the “Other” button you will need to do some conversion in order to correctly price instruments that use different unit values.

- Divide the unit value by the number of day

- Divide the result by 100 and enter that value into the storage rate along with the specified interest rate

Example:

- Storage rate per ton is 4,65 GBP/month:4,65/30 = 0 .155

- Divide 0.155by 100 (0.155/100 = 0.00155 )

- Enter that value in Storage rate

- Change interest rate to current interest rate

The example below shows the Cost of Carry for Corn: