The Commodity Channel Index is an oscillator used in technical analysis to help determine when an investment vehicle has been overbought and oversold. The Commodity Channel Index, first developed by Donald Lambert, quantifies the relationship between the asset’s price, a moving average (MA) of the asset’s price, and normal deviations (D) from that average.

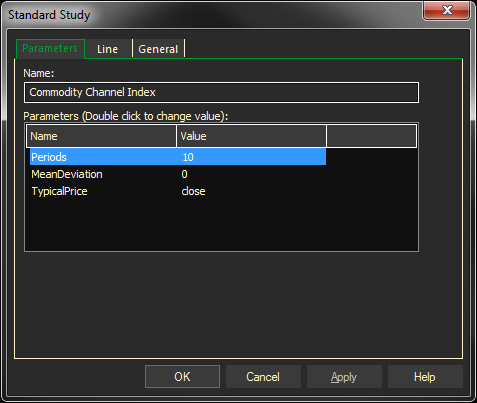

Parameters:

Symbol — data source symbol.

Period — time interval

Mean Deviation — calculate the absolute value of the difference between the last period’s SMATP (Simple Moving Average of the Typical Price) and the typical price for each of the past 20 periods. Add all of these absolute values together and divide by 20 to find the Mean Deviation.

Typical Price — (H+L+C)/3 where H = high, L = low, and C = close.

Example with defaults: CCI (SP@1, 10,0,0.00)

Adding the Commodity Channel Index Study to a Chart:

- Click on the f(x) Studies docked pane window.

- Click on the plus sign to expand the fx Standard.

- Find the Commodity Channel Index study, drag and drop it on the chart

Or

- Right-Click on a blank part of the chart and select ADD STUDY.

- The Add Study dialog box will open.

- Under Data Source, you will find a list of charts and studies in the window. Select the one on which you want the new study to be based.

- Under Studies, select the study you want to add to the window. The library of studies will include standard ProphetX studies plus those that you have created. The Most Recent will include studies that you have previously used.

- Under Add To, select the stack you want to add the study to, or select <New Stack> to create a new stack for the study.

- Click OK to exit.

Changing Parameters:

- Do either of the following to change the parameters

- For an existing study on a chart, right-click on the study and select PROPERTIES on the pop-up menu, and modify as necessary.

Right-click on the study name listed in the f(x) docked pane and make the changes in the displayed dialog. Update will save the parameters permanently.

Example of a Chart with a Commodity Channel Index study