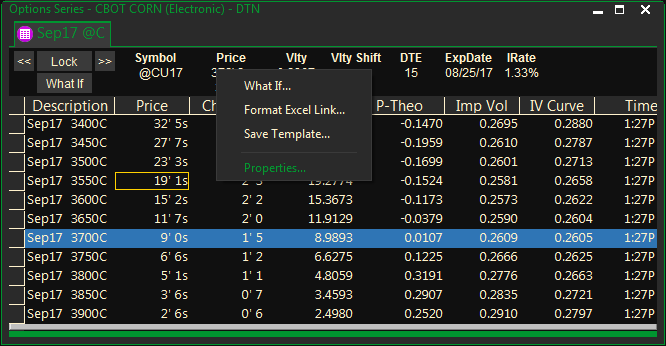

You may change many of the values and parameters used in options pricing as part of your assumptions and the what-if analysis that you do. To change values that affect the whole window, right-click on the underlying section (bar at the top of the window) and select Properties or the What If command from the pop-up menu as shown on the left.

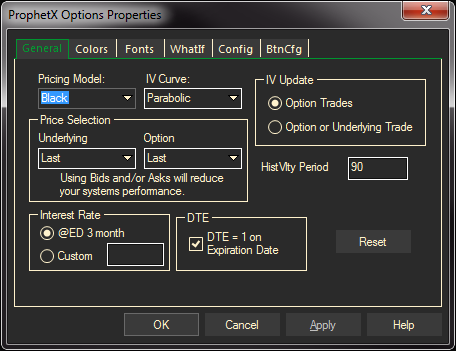

General Tab

Options Window: The Underlying Section

The underlying section at the top of an options window contains values for the underlying instrument as well as properties that apply to individual strikes.

The underlying section contains the following information:

- Symbol: The Underlying Symbol of the instrument used in this window. All of the initial values, such as price, expiration date, etc., are based on this symbol.

- Price: Underlying price used in calculating the pricing model. This price is determined by the U-Bate field which identifies the value to use (last, bid, ask, recent).

- Vlty: This value is a 90 day historical average of volatility on that contract.

- Vlty Shift: A value that will be added to the volatility curve.

- EDate: The expiration date of the options as determined by the trading rules for this instrument. These are set in the Properties dialog.

- IRate: The interest rate used in the pricing model.

Underlying Properties

The UNDERLYING PROPERTIES command lets you quickly change values that affect an options window. This, and additional commands that affect the entire window, are on the menu that opens when you right-click in the top section of an options window.

The following values may be changed in the Underlying Properties dialog:

Pricing Model: Specifies the pricing models available to you. You may specify Black, Black Scholes, or Garman K.

IV Curve: The type of skew used is selected under Implied Volatility Curve. The default skew is Parabolic. Skew types are shown in the table below.

| Skew Type | Calculation |

| Avg. Implied | Average of implied volatilities of strikes |

| Linear | y = ax + b |

| Quadratic | y = ax2 + b + c |

| Cubic | y = ax3 + bx2 + c |

| 4th Order | y = ax4 + bx3 + cx2 + d |

| 5th Order | y = ax5 + bx4 + cx3 + dx2 + e |

| Hyperbolic | y2 = ax2 + b + c |

| Hyperbolic 3 | y2 = ax3 + bx2 + c |

| Hyperbolic 4 | y2 = ax4 + bx3 + cx2 + d |

| Hyperbolic 5 | y2 = ax5 + bx4 + cx3 + dx2 + e |

Underlying Price Selection: Specifies which price value of the underlying instrument to use in the pricing model.

LastBidAsk – the most recent of last, bid, or ask

- Last – the last traded price

- Bid – the most recent bid price

- Ask – the most recent ask price

- Previous – the price previous to Last

Option Price Selection – Specifies which price value of the option to use in the pricing model. The selections are LastBidAsk, Last, Bid, Ask, and Previous, described above.

HistVlty Period: The number of days used to calculate the historical volatility period. The default is 90

Interest Rate: Specifies the interest rate used in the pricing model of all options. A change in this value will be reflected in the IRate field of the underlying section.

DTE: (Days to Expiration) Specifies the expiration date of the options as determined by the trading rules for this instrument. This is indicated by the number of days. A change in this value will be reflected in the EDate field in the underlying section (top part of the window).

If checked, DTE will display the expired options last day.

IV Update: Specifies when the Implied Volatility of an option is calculated. (Please note: This is the most frequently asked question on options)

The selections are:

- Option Only – Calculate the Implied Volatility only when the option trades. The underlying price used in the calculation is the price at the time the option last traded.

- Option or Underlying Trade – Calculate the Implied Volatility of the option when either the option or its underlying instrument changes in price

When a value is entered under X Seconds, the window will only calculate every [interval] seconds. Any price changes received before [interval] seconds has been reached will be held until the interval is over. When the interval is over, the most recent values for the underlying instrument will be used.

To recalculate the pricing model after every update, set the X Second value to zero (0).

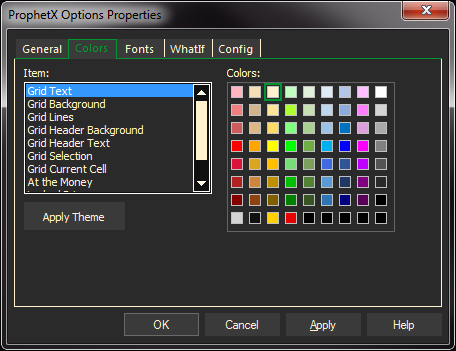

Colors Tab

You can change the color of Header and Grid text (foreground), background, and grid lines.

- Right-click on the options page or on the Underlying Section (bar at the top of the window) and select Properties from the pop-up menu.

- In the Properties dialog, select the Colors tab.

- Select an element to change: Background, Foreground (text), or Grid Lines.

- Click on a color for the selected element. If you wish, click Apply to view your changes while the dialog remains open.

Repeat steps 3 and 4 to make other changes. Then do either of the following:

- Click OK to apply the changes and close the dialog.

- Click Cancel to exit: only changes made before clicking Apply will remain.

You can add colors to this dialog, replacing any shown. Double click on any color box to open the color editing dialog. Select a color to replace the one currently in the box and click OK. Like color editors for other windows-based programs, this dialog also lets you create your own colors for use in the window.

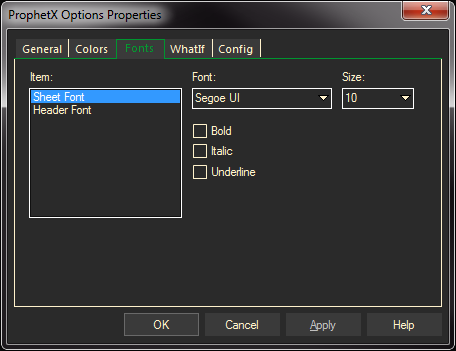

Fonts Tab

Change Options fonts by right-clicking in the upper portion of the display.

- Select Properties

- Select the Fonts tab

- Change the fonts to your preferences

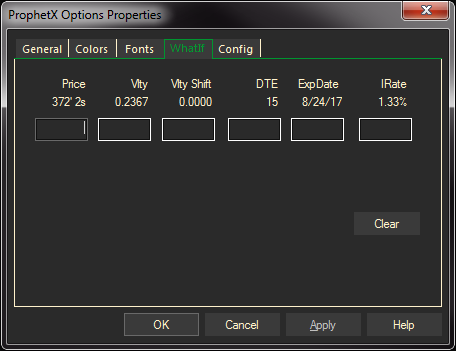

What If Tab

In the Options Properties you can do “what if” situations to see how the options would be affected under specific conditions.

- Right-click in the upper portion of the Options display

- Select What If or Properties

- Select the What If tab

Change any of the entries in white to recalculate the options based on your “what if” criteria.

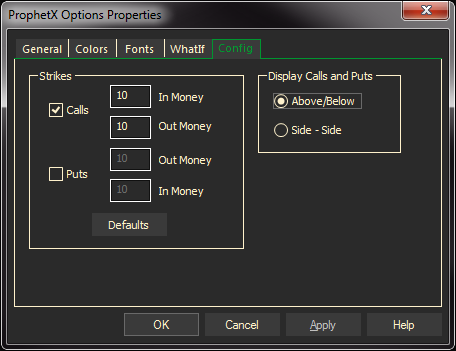

Config Tab

Changing the View and Number of Display Strikes

You may specify the number of strikes to display after you create the options window.

To Change the View of the Display Strikes:

- Right-click on the Options window, select Properties

- In the Options Properties, select the Config tab

- In the Display Calls and Puts area, select how you would like to view the Calls and Puts – Above Below or Side By Side

To Change the Number of Display Strikes:

- Right-click on the Options window, select Properties

- In the Options Control Properties, select the Config tab

- In the Strikes area, select Calls or Puts and enter the number of strikes you would like to display for In Money and Out Money

- Click the OK button

Tip: The number of strikes you display will directly affect the results of your calculations. If you select too many strikes, it will use the strikes that are way out and not trading. If you select too few strikes, it may not have enough strikes to display your data correctly.